In 2023, the world economy has exceeded the initial expectations (5), which predicted of a greater slowdown in growth, and is making moderate progress in the recovery after the impacts of the Covid-19 pandemic, the war in Ukraine, and the cost of living crisis.

However, despite this positive surprise, economic growth has slowed down again for another year and the outlook for 2024 points to a continuation of this trend(6) in a context marked by war and geopolitical tensions, and the impact of inflation and high interest rates on the disposable income of families and companies.

Precisely to reverse these inflationary tensions, the European Central Bank and the Fed in the USA have pursued policies aimed at reducing their balance sheets and raising interest rates.

Price change indicators, which began the 2023 financial year at very high levels, have progressively slowed their increases in this environment of contractionary monetary policies by central banks and as global supply chains have rebalanced after the strong imbalances experienced in previous years.

In terms of exchange rates, the Euro has appreciated against the US dollar after a 2022 revaluation of the North American currency due to its nature as a safe haven currency, which reached parity against the European currency.

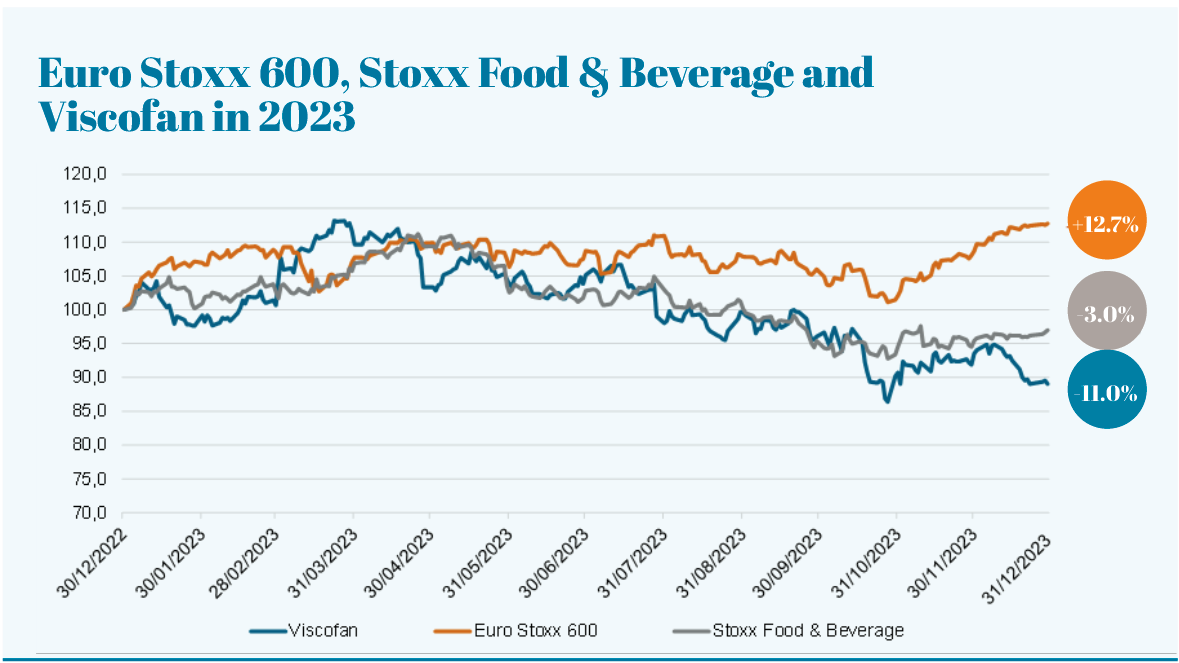

The main stock market indices have closed the year 2023 with increases, recovering from the decreases of the previous year, driven largely by better-than-expected global economic growth, and the announcements by the Fed and the European Central Bank of the end of the increases in interest rates due to the slowdown in inflation in the last months of the year. In the United States, the S&P 500 index gained 24.2% in 2023, and in Europe the Euro Stoxx 600 gained 12.7%, the German DAX gained 20.3%, and in Spain the Ibex 35 gained 22.8%.

In particular, the food sector, of which Viscofan is a member both in Spain (Consumer Goods segment, Food subsector) and in Europe (Euro Stoxx Food and Beverage), has decreased by -3.2% and - 3.0%, respectively, impacted by the inventory reduction movement in part of the sector and uncertainty of demand due to the impact on households' disposable income of inflation and interest rate increases.

The casings industry and Viscofan have not been immune to this trend, which has resulted in a decline in market volumes, leading to Viscofan lowering its growth prospects in the publication of its third quarter results, in a year also marked by the high energy cost in the income statement. As a result of the above Viscofan's share price closed 2023 at €53.60, a decrease of 11.0%, and of 8.2% if the payment of dividends is considered.

(5) In its October 2022 report, the IMF report anticipated global GDP growth of +2.7% in 2023 compared to the +3.0% forecast in its October 2023 report.

(6) According to the IMF, global growth will moderate from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, well below the historical average (2000–19) of 3.8%.

The average daily market price in the year was €60.48 per share and Viscofan's market capitalisation stood at €2,492 million at the end of 2023.

In addition, nearly 11 million Viscofan shares were traded on the Spanish continuous market during the year, with cash traded of €663 million, equivalent to a daily average of €2.6 million.

Viscofan's share capital consisted of 46,500,000 shares of €0.70 par value each, of the same class and fully paid-in.

Viscofan's shares are admitted to trading on the Spanish stock markets, listed on the continuous market, since the company's exit from the stock market in December 1986.

It is listed on the Madrid Stock Exchange General Index (IGBM) and forms part of the Consumer Goods segment, within the Food subsector, the Ibex Mid Cap and at European level to the Euro Stoxx Food and Beverage index and the Stoxx Europe 600 index.

Since October 2023, Viscofan has been part of the IBEX ESG, the family of indices launched by BME (Spanish Stock Exchanges and Markets) to promote sustainability.

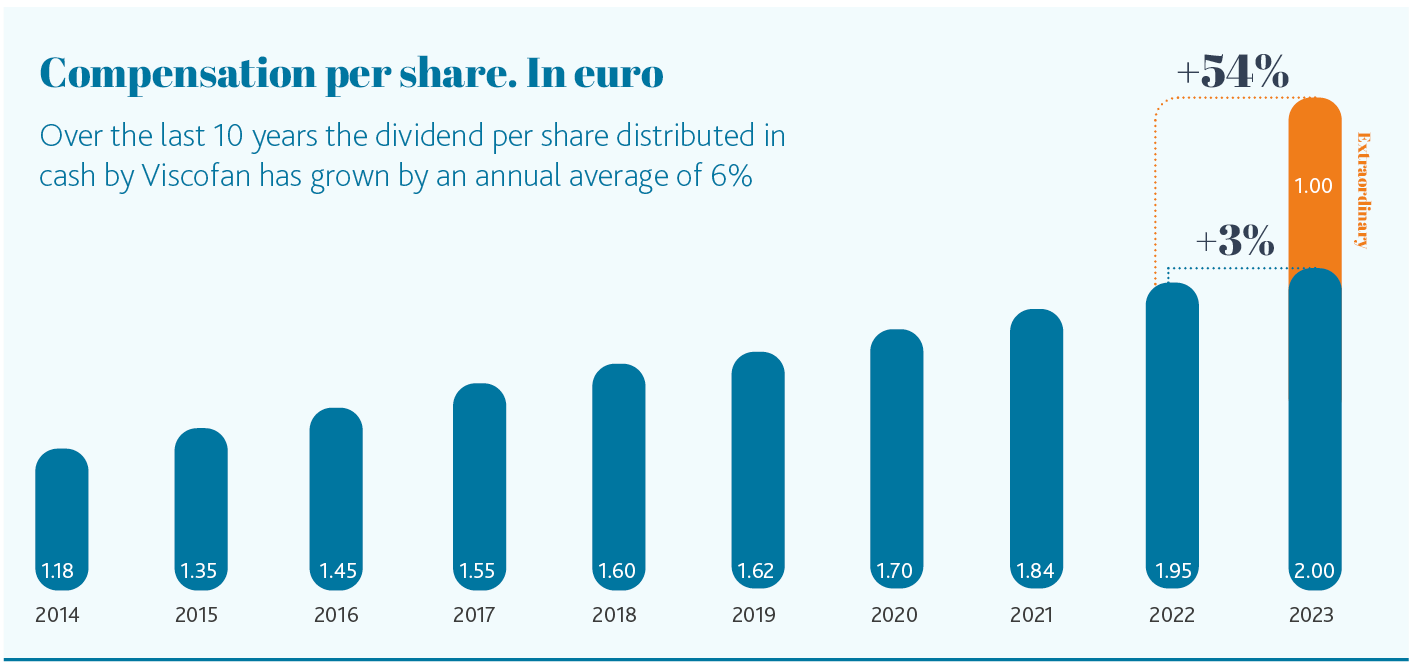

Throughout the different strategic plans, the Viscofan Group has built a sound and flexible business model. This characteristic entails the creation of cash flows that allow investment projects to be carried out in order to improve value creation, which is shared with shareholders in cash and at the same time maintaining a sound balance sheet structure. I this respect, the Board of Directors of the Viscofan Group has resolved to propose to the General Shareholders' Meeting a profit distribution equivalent to a remuneration of €3.00 per share. Of which €2.00 per share - equivalent to the distribution of 65.6% of net profit - is of an ordinary nature, and €1.00 per share is of an extraordinary nature after completion of the first half of the Beyond25 strategic plan with higher than expected operating cash flows. Shareholder remuneration consists of:

• An interim dividend of €1.40 per share (paid on 20 December, 2023).

• The proposed ordinary final dividend of €0.59 per share and extraordinary final dividend of €1.00 per share under the optional dividend system in cash or shares “Viscofan Flexible Remuneration” in a lump sum payment expected in June 2024.

• A bonus of €0.01 per share for attending the General Shareholders’ Meeting.

The proposed total and ordinary distribution are 53.8% and 2.6% higher than the previous year's remuneration of €1.95 per share, respectively.

Likewise, in terms of ordinary remuneration, over the last 10 years the dividend per share distributed in cash by Viscofan has grown by an annual average of 6% from €1.12 in 2013 to the €2.00 proposed by the Board of Directors against 2023 results. In terms of yield, the proposed ordinary dividend for 2023 represents 3.7% of the closing share price for the year.

One of Viscofan’s objectives, through its Department of Investor and Shareholder Relations, is to create value for the investor community by improving accessibility, the transparency of information and providing shareholders with relevant information of a financial and non-financial nature, on its strategy and on its operations to gain a better understanding of the company.

To ensure this information flow and to grant certainty to shareholders, markets and other stakeholders on the transparency and access to information, Viscofan has a Communication policy with shareholders, institutional investors, advisors on voting and economic-financial, non-financial and corporate information, defined in conformity with the good governance practices and recommendations applicable to listed companies.

Viscofan provides the investment community with a multitude of communication channels: presentations at seminars and events organised by the financial community, roadshows with institutional investors promoted by the company or by brokers, earnings presentations, the General Shareholders’ Meeting, organised visits to Viscofan’s head office, telephone calls to a dedicated investor and shareholder helpline, a special e-mail address, notifications and regular public information submitted to the CNMV (Spanish National Securities Market Commission).

Also, the information published on the website www.viscofan.com:

• In the Investor Relations section in which Viscofan makes the latest news, reports and quarterly presentations of results, annual report, share price performance and other information of interest, etc., available to the public.

• The Sustainability section details information on Viscofan's main commitments to the Sustainable Development Goals, sustainability indicators and the 2030 commitments set out in the Group's Sustainability Action Plan.

• Viscofan's Corporate Governance section publishes the information relating to the Board of Directors, committees, policies and regulations and other related information of interest.

Viscofan also maintains fluid communication with the financial markets, so that at the end of 2023 a total of 15 analysis companies, both national and international, are covering the company.

At the same time, Viscofan encourages direct or remote contact through face-to-face meetings with investors, both shareholders and non-shareholders interested in the company. In 2023, Viscofan held a total of 183 face-to-face or video-call meetings with investors – shareholders or otherwise – in the framework of seminars and events held by the financial community. In 2022, there were 253 meetings of this type.

The communication effort carried out throughout all these years has been recognised by the investment community. In 2023, Viscofan was recognised by Institutional Investor, in its Developed Europe Executive Team awards, as Best Investor Relations Professional and Best Investor Relations (IR) Team, within the Small/Mid Cap category of the Paper & Packaging sector. It was also mentioned in the top 3 for Best IR and ESG Programmes. In the All Caps category of the same sector, Viscofan came second in the awards for Best IR Professional and Best IR Team and came third in the awards for Best IR Programme.

Bidirectional communication is important, since the questions and concerns of the financial community are taken into account and transmitted within the company, such as financial, strategy, sustainability and corporate governance matters.

In 2023, the most frequently asked questions have been related to the impact of inventory reduction by customers, energy cost inflation, the evolution of New Businesses, sustainability projects at Viscofan, and shareholder remuneration, among others.

| Period Beyond25 |

Period MORE TO BE |

||||||||

| Share price € | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | ||

| Year-end | 60,20 | 56,90 | 58,05 | 47,10 | 48,12 | 55,01 | 46,85 | ||

| Maximum in the year | 63,65 | 61,45 | 64,35 | 56,55 | 66,20 | 56,33 | 56,06 | ||

| Minimum in the year | 48,92 | 53,25 | 43,28 | 40,12 | 46,20 | 46,75 | 41,84 | ||

| Viscofan's performance on the continuous market | Year-end 2022 | Year-end 2021 | Year-end 2020 | Year-end 2019 | Year-end 2018 | Year-end 2017 | Year-end 2016 | ||

| % ann. change Viscofan | 5,8% | -2,0% | 23,2% | -2,1% | -12,5% | 17,4% | -15,8% | ||

| % annual change IGBM | -4,8% | 7,1% | -15,4% | 10,2% | -15,0% | 7,6% | -2,2% | ||

| % annual change IBEX 35 | -5,6% | 7,9% | -15,5% | 11,8% | -15,0% | 7,4% | -2,0% | ||

| % Annual Change Euro STOXX 600 | -12,9% | 22,2% | -4,0% | 23,2% | -13,2% | 7,7% | -1,2% | ||

| % Annual change IBEX Medium Cap | -7,4% | 8,6% | -9,7% | 8,4% | -13,7% | 4,0% | -6,6% | ||

| % annual change Sub-Sector Food and Beverages IGBM |

-0,7% | -1,6% | 10,6% | 1,8% | -8,4% | 5,2% | -5,4% |

| Stock exchange trading data | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | ||

| Capitalisation at year-end (Mn €) | 2.799,3 | 2.645,9 | 2.699,3 | 2.190,2 | 2.242,6 | 2.563,7 | 2.183,4 | ||

| Continuous market traded cash (Mn €) | 763,3 | 1.135,8 | 1.561,8 | 1.230,5 | 1.669,1 | 1.995,2 | 2.707,1 | ||

| Average per session (€Mn) | 3,0 | 4,4 | 6,1 | 4,8 | 6,5 | 7,8 | 10,5 | ||

| Traded shares | 13.893.544 | 19.626.412 | 28.338.888 | 25.815.115 | 29.807.220 | 38.658.041 | 54.701.597 | ||

| Daily average of traded shares | 54.060 | 76.666 | 110.268 | 101.236 | 116.891 | 151.600 | 212.022 |

| Ratios per share | Year-end 2022 | Year-end 2021 | Year-end 2020 | Year-end 2019 | Year-end 2018 | Year-end 2017 | Year-end 2016 | ||

| Shares admitted to trading | 46.500.000 | 46.500.000 | 46.500.000 | 46.500.000 | 46.603.682 | 46.603.682 | 46.603.682 | ||

| Basic earnings per share (1) | 3,02 | 2,87 | 2,63 | 2,27 | 2,66 | 2,62 | 2,68 | ||

| Proposed ordinary remuneration per share (2) | 1,95 | 1,84 | 1,70 | 1,62 | 1,60 | 1,55 | 1,45 |

(1) Basic earnings per share are calculated by dividing net earnings by the weighted average number of ordinary shares outstanding during the year, excluding treasury shares.

(2) Includes the interim dividend, final dividend, return of share premium, return of capital contributions and the bonus for attendance at the General Meeting

Uso de cookies

Utilizamos cookies propias y de terceros para analizar nuestros servicios y mostrarle publicidad relacionada con sus preferencias. Pulsando “Configurar” puede seleccionar las cookies que se instalarán en su dispositivo. Pulsando “Aceptar” consiente su instalación y el uso de todas las cookies que utilizamos. Puede obtener más información aquí.

ACEPTAR COOKIES Configuración de cookies